I don’t own a business at the moment, but it’s not like I’m never going to. I have plans, and I’m working towards them. So right now, I’m an employee for a great company that takes care of its employees well, but I’ve also been a part of a company that didn’t care about its employees at all. Why does it matter?

According to research done by Oxford University, it revealed that happy employees are 13% more productive. Professor De Neve said ‘We found that when workers are happier, they work faster by making more calls per hour worked and, importantly, convert more calls to sales” (Happy workers are 13% more productive, 2021)

As someone who has been a happy and unsatisfied employee, I can tell you that yes, happy coworkers are more productive. But if you own a business, what can you do to make your staff happy? Well, just for that, I’m here.

Coming from an employee, I will tell you the benefit plans from a business perspective. These plans will help you satisfy your employees, which will result in the growth of your business. So stick around till the end. Also, learn about Boosting Your Business With Specialized Tech Services by reading this article.

The Importance of Employee Benefits

Employee benefits are important and let me tell you why, when you are providing certain benefits to your workers they feel cared for and that their needs are being taken care of. These perks result in employee satisfaction and loyalty.

But if you are unable to give benefits to your colleagues that will result in them not being serious about their work as they would feel left out and salary is not the only way to keep them satisfied.

DID YOU KNOW?

As of 2024, there are over 3.5 billion employees worldwide!

Common Types of Benefit Plans

Let me break down certain benefits plans for you:

- Retirement Plan: These plans will help your employees think about their future so that when they retire, they won’t have to struggle financially.

- Flexible Spending Accounts/Health Savings Accounts: Opening such accounts will result in employees paying less for medical expenses.

- PTO: Paid Time Off so your colleagues can go on vacations and charge up. Paid medical leave is also a great way to show that you care about their well-being.

- Wellness Program: Mental health support, and gym memberships to promote a healthier workforce.

- Health Insurance: Covering a wide range of health expenses.

I told you about common benefits plans, but what plan is right for your business? That I will talk about in the next heading.

Choosing the Right Plan for Your Business

Choosing the right plan for your business is essential, causing if you choose the right one, it can put your business at financial risk. So if you own a small business, go for a cost-effective plan like PTO and well programs.

For small businesses, offering comprehensive benefits can seem financially daunting. However, there are solutions such as pooling resources with other companies. Moreover, at https://mochamber.com/news-archive/chamber-benefit-plan-news/, and other similar websites you can read more about how they can help a business prosper. That way, you’ll be more sure that you’ve made the right decision.

But if you own a big business with great revenue then go for bigger plans like health insurance, retirement plans, stock options, etc. Before choosing a plan, you have to understand your business.

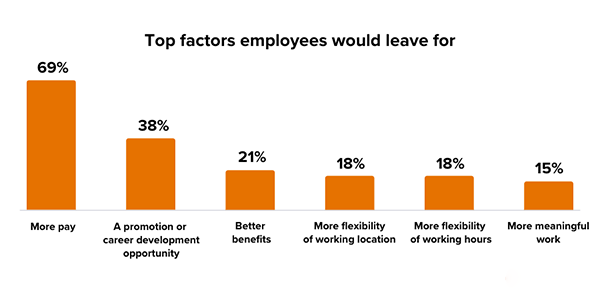

Take a look here and learn what potential reason an employee would leave the company.

Legal and Compliance Considerations

There are legal laws and compliance related to employee benefits released by state and federal laws, and these need to be taken into consideration. A few of these laws include:

- ERISA: Employee Retirement Income Security Act

- HIPAA: Health Insurance Portability and Accountability Act

- ACA: Affordable Care Act

- FMLA: Family and Medical Leave Act

These laws are made in favor of employees, so if the employers fail to comply with them, they’ll be facing legal consequences that could end with hefty compensation.

Managing Costs Without Sacrificing Value

Providing benefit plans does cost a lot of money, but certain strategies could manage costs without sacrificing value some of them are mentioned below:

- High Deductible Health Plan (HDHP): If you are looking to lower the monthly premium on health insurance, apply HDHP here workers will pay more from their pockets to cover the health insurance. But it seems like it is reducing the value, right? That’s why apply a Health Saving Account to balance it out.

- Promoting Health Program: Promoting health programs like wellness-based activities doesn’t cost much but increases quality.

- Voluntary Benefits: Let your employees hold on to what benefits they want and according to their choice make a plan where you both contribute to it.

These are some of the ways for you to reduce costs while maintaining quality. So far in the article, I talked about all the things that you could do to provide benefits to your employees and if you could follow through, this will benefit your business in the long run.