In today’s constantly evolving business market, Fintech has revolutionized the way small businesses access capital today. Also, learn about Fintech Solutions to Secure Funds by reading this article.

A while back where small businesses used to end up without gaining any financial packaging due to the lengthy procedure of traditional lending, Fintech uses new digital technology to speed up the process of getting funded.

This innovative sector has introduced fast, flexible innovative solutions that are specifically targeted at meeting the specific needs of small enterprises.

In this article, we are going to learn how Fintech will change the field of small business financing in 2024 and beyond.

Take an insight into this blog, and learn how the latest trends, tools, and platforms encourage entrepreneurs to be on top of their game in the competitive market.

The Shift from Traditional Lending to Fintech Solutions

Today, many small businesses looking for faster and more accessible financial options are turning from traditional platforms to Fintech.

Banks and conventional lenders, known for their extensive documentation requirements and protracted approval times, are losing ground to Fintech companies that embrace new digital technology.

This development marks a vital juncture in the changing models of financing small businesses, making access to venture capital easier and more realistic for entrepreneurs than ever before.

Do You Know?

Visa is the largest fintech company with a valuation of almost half a trillion USD.

Access to Capital through Digital Platforms

Digital platforms are revolutionizing how small businesses receive financing by using innovative technologies, however, traditional lenders tend to depend on credit scores and collateral.

Fintech platforms such as Kabbage and OnDeck make use of cash flow patterns, transactional data, and even social media presence in their assessment of a business’s creditworthiness.

Also, embedded finance allows the integration of lending in platforms such as Shopify, meaning access to capital that is indissolubly linked with real-time sales.

Other emergent trends include DeFi, (Decentralized Finance) a phenomenon where loans are available on a peer-to-peer basis through decentralized networks such as Aave and Compound.

It eliminates the use of conventional intermediaries in their dealings, and such advancements mark the creation of a new data-driven financial ecosystem in 2024 with better access to capital in response to different business needs.

Lower Fees and Greater Transparency

Digital financing platforms imply lesser charges and much more transparency, which is a great help for small businesses.

Traditional lenders often have high interest rates and hidden charges, making it expensive to borrow.

In contrast, a number of Fintech solutions have far more competitive pricing structures with crystal clear breakdowns of fees that apply to a loan.

Digital platforms use technology to bring greater transparency in the way loans are given.

This provides an avenue where borrowers can easily access upfront, key information such as terms, repayment schedules, and the total cost of financing.

With real-time data and accessible dashboards, businesses can keep tabs on their financial obligations and make needed adjustments to strategies so that companies are never hit with unexpected costs.

Innovative Financing Models for Small Businesses

New financing models in 2024 are revolutionizing the way small businesses are accessing capital.

Where traditional loans have strict rules and unchangeable conditions, Fintech companies offer flexible options that adapt to diverse needs.

Ahead revenue-based financing links repayments with actual revenue performance to make it easier for you to fix monthly payments without any pressure.

Moreover, crowdfunding platforms like Kickstarter and Indiegogo allow you to raise funds directly from the public, offering them shares or future product sales in return.

Besides, invoice financing allows access to credit against outstanding invoices, enhancing cash flows due to the availability of immediate cash.

Further, subscription-based financing is also gaining traction, wherein the business pays to subscribe for funding that can be accessed if required.

Research Fact:

The fintech market is expected to exceed $340 billion in 2024 and reach $1,152 billion by 2032.

The Role of Link Building in Boosting Fintech Visibility

A strong link-building strategy is very effective in improving the online presence of Fintech companies.

Building quality backlinks from trusted sources will enable a Fintech firm to improve its search engine ranking by generating more organic traffic to its website.

Using services like Seeders.com helps in linking up the business to various authoritative websites.

Also, a good link-building strategy may also position this Fintech company as an industry leader.

Collaboration with influential sites and participation in discussions form relationships that help in brand awareness and establishing trust with potential clients.

Interaction with resources such as https://seeders.com/seo-france/ boosts the visibility of such firms to position them for sustainable growth in the competitive market.

What is Link Building in the Fintech Context?

Link building, in regard to Fintech, involves gaining hyperlinks from other websites, which will help raise a company’s presence online and build authority.

This action will produce improved search engine rankings, organic traffic, and visibility.

A Fintech company, when offered quality backlinks from trusted sources within the industry, is in a position to establish credibility and build relationships necessary for better sustainability within the competitive market.

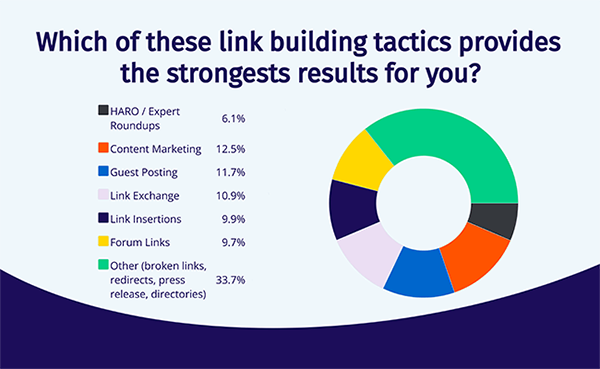

Link-Building Strategies for Fintech Companies

Effective link-building for FinTech companies will involve creating high-quality, relevant content that naturally attracts backlinks, guest posts in collaboration with industry influencers, and active participation in various forums and discussions.

Most importantly, the company has to leverage its partnership with reputed financial websites and PR campaigns to increase visibility.

Finally, using tools to monitor backlinks helps maintain strong link profiles and improves search engine rankings.

How Small Businesses Can Leverage Link Building to Access Fintech Services

Small businesses can use link building to tap into Fintech services by illustrating increased online authority.

This includes producing insightful articles or guides on financial topics relevant to their industry.

They can attract backlinks from trusted Fintech platforms, and build networking through industry events or forums that may present them with opportunities to establish connections leading to valuable partnerships.

Real-Time Data and Financial Insights for Better Decision-Making

Real-time information and insights on finance are revolutionizing the way decisions are made in small businesses.

With advanced analytics capabilities, it would track everything from key performance metrics to real-time cash flow. This enables firms to make better and quicker decisions.

Integrating real-time data into financial planning increases precision in forecasts and budgets.

This ensures small businesses address challenges with clarity and poise, and financial insights from platforms help foster growth and success.

Conclusion

In 2024, Fintech companies are revolutionizing the small business landscape in terms of financing through faster, more transparent, and innovative solutions.

For small enterprises, access to capital will become even more attainable and well-informed through the utilization of digital platforms, real-time data, and advanced analytics.

Link building has adeptly improved visibility, thus empowering the firms to connect with valued Fintech services.

As the financial ecosystem keeps changing, such trends will finally put the small business owner on the track of sustainable growth and competitive advantage in the marketplace.