I’ve been thinking about opening my own business in the future. Just the thought of it gives me a sense of satisfaction that I’ll be the boss, I’ll have subordinates, etc. I’m sure there must be more people who have the same thinking as me. But is it possible to just wake up one day and decide to open a company?

Former United States Secretary of State Colin Powell once said, “A dream doesn’t become reality through magic; it takes sweat, determination, and hard work”. Opening a company is also a dream, and it is going to require a lot of handwork and whatnot.

But there are things I’m aware I have to do before opening my own startup, and I’m going to share it here. In this article, I will talk about things that everyone should know before opening a new company. These are some important details, so let’s get into it. Also, learn about Managing Your Company’s Online Reputation on Instagram by reading this article.

Choose the Right Business Structure

I will be honest here, I didn’t know that there are different business structures, but now I do. To make it simple, I’m mentioning all of them below so you could also know about them:

- Sole Proprietorship: In this type of structure, I’ll be the sole owner of the business and I will have full control over the thing. As good as it sounds, if my company goes into any debt or loss, I will be the only person responsible for it.

- Partnership: Suppose the idea of opening a business was mine and my friend’s, and we opened it, so now it is a partnership organization. Now every profit, loss, tax, personal liability everything would be divided. But partnership often ends with conflicts among each other, and I’m not good with confrontation.

- Limited Liability Company (LLC): This structure is going to cost me a lot more money but will offer my company liability protection. This could be applied in sole proprietorship or partnership.

- Corporation: If I want to raise capital for my business, what I will do is I will adopt the corporation structure and shares of my company will be sold and now shareholders will buy them and raise money. But these shareholders won’t be responsible for my debt or losses, and I won’t be considered an owner any further.

- Nonprofit Corporation: Just in case I ever decide I want to do good for people and not make a profit out of it, I will open a nonprofit organization all the investment, and funding will be done by me, and all the donations done by people or government will again be used in the organization there won’t be any distribution of profit or anything.

- Limited Company: A limited Company can be of two types, The first will be a Private Limited Company (PVT) in this structure shares of my company won’t be sold publicly, and only limited people have shares that too within the company. Another is a Public Limited Company (LTD) where shares of my company can be purchased by anyone.

So, these are the different business structures and anyone who wants to start a business needs to choose very carefully. But if I was from the UK, I could’ve taken help from UK company formation options. They would’ve helped me with several things while setting up my business.

Create a Solid Business Plan

Now that you’ve decided what structure you want your business to have, it’s time to create a solid plan. You’ll be starting with choosing what type of business you want to open. Once figuring that out, you will analyze the market if it would be able to stand out or not.

You would have to make goals for my company, different strategies, competition, creating a unique selling proposition (USP), and more such things. If I summarize it and keep it simple, You would have to create a blueprint for the company.

You will follow that blueprint and build my company brick by brick. This isn’t an easy process to create a plan, it requires a lot of thinking because one bad decision can cost almost everything.

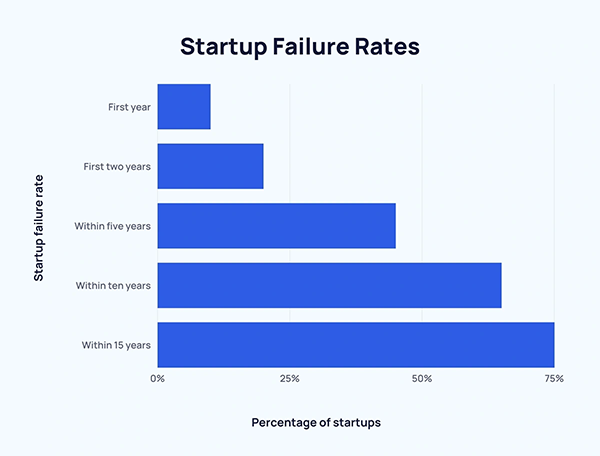

Because, look at the graph below, shows the failure rates of startups. Even though I didn’t know this, any business could be a failure in the first year or even in fifteen, it doesn’t matter.

That’s why making a long-term plan would be the key for anyone to stand out in the market and make changes accordingly.

Register Your Business Appropriately

I don’t want you to start an illegal business and get in trouble with the government. That’s why, to solve this problem, I’m going to suggest that you register your business with either the state or federal government. This will allow the business to run without any issues.

But just registering will keep the company safe? No, you would have to buy all the legal patents so no one else could copy anything from you, you have to fill in all the necessary documents and even pay fees.

This is another time-consuming process because depending on the size and type of the business, it could take days or even months to get verified.

Understand Your Tax Obligations

You will have to pay special attention to your tax obligations because if you don’t, you could get into financial as well as legal trouble. Hiring a tax professional would be a wise choice since they’ll help an individual understand all the local tax laws and regulations.

Based on the structure of the business, taxes would be different for a non-profit organization, you would be paying very less to no tax. But any other form like partnership or PVT is the other way around.

Secure Necessary Licenses and Permits

I used to think this is the same as registering the business, but it turns out it’s different. Based on the location and type of my business, you would need legal and verified permits. Suppose you decided to open a medicine factory, you would need a drug manufacturing license.

Depending on the type of goods one might need to import or export, you would need a permit for it. It’s hectic but necessary and there is no way anyone could skip this step because, without a necessary permit or license, a company could be closed in an instant by the authorities.

FUN FACT

More than 137,000 businesses are opened every day in the world.

Plan Your Finances and Funding

Finally, finance and funding, I don’t think anyone could start a company without any savings or funding. So, if you have decided to open a business, you will have to start applying for loans or use your own money.

This doesn’t only apply while opening the business, as long as the business is going to run you will have to maintain and plan your finances. Any business I see around me has its finances in order, and they know in case of an emergency where they can get the funds.

This is the reason why those companies are successful. Now these are all the essential points I think everyone should know. I hope you will follow these tips before starting a business.