As an investor, I like to manage my portfolio without any external help. But handling it yourself comes with certain risks that can completely ruin your investments. So, what can you do to prevent this? And what steps need to be taken if you are taking care of your finances?

Before I answer it, let me tell you about a case study that said, “Strategic portfolio management forges a critical link between the strategic planning process and the project execution process, enabling management to reach consensus on the best use of resources” (Gain Advantage with Strategy-Aligned Portfolio Management, 2021). This case study tells you why strategic portfolio management is important.

Now to the main topic, I’m here to tell you how you can choose the right investment for yourself and what steps you have to take. Look, doing things on your own does give you a lot of freedom, but it comes with risk, so read this article carefully. Also, learn about How to Diversify Your Portfolio with Index Funds by reading this article.

1. Understand Your Investment Goals

First thing first, you have to understand your investment goal and why you are making this decision. There could be multiple reasons like wealth preservation, capital growth, or income generation. There could be more reasons, but these are the most common ones.

If you don’t know what you are aiming for, then you will for sure make mistakes. Being clear in your head shows you the right path but being confused only messes things up. I invest to increase my capital, and with that in my head, I make any move further.

2. Diversify Your Investment Portfolio

What do you understand by the term diversify? Does that mean not being limited to one thing and being varied? Yes, this is correct, but why is being diversified important in investment? To give you a simple answer, it manages risk and balances your finances.

A varied portfolio with a mix of bonds, stocks, cash, and real estate helps you maintain your finances so in case if any of your assets don’t perform well you can still recover easily. But if you have invested in only one asset, you will face a big loss if the market crashes or your asset underperforms.

Never make this mistake and keep your investment diversified. This would help you in the long run.

3. Consider Direct Property Investments

You must’ve heard people saying how investing in property or real estate was the best choice they made. John Stuart Mill himself said, “Landlords grow rich in their sleep without working, risking or economizing.” So must have gotten an idea of what benefits you get from investing in different properties.

These investments are less volatile and their value increases with time, you can make good money out of it by either selling or renting. However, property ownership requires higher capital, and it isn’t a liquid asset that you can see anytime, it takes time. If you can commit to a long-term investment with the best returns, this is the best for you.

DID YOU KNOW?

As of 2024, Berkshire Hathaway is considered to be the most expensive stock, valued at $686,000 per trade!

4. Evaluate Shares and Equities

Investing in shares and equities is very profitable as they give great returns over time, but they are also the riskiest. Before investing in these assets, you have to learn about the company whose stocks you are thinking about buying. Where does it stand in the market, what are its previous records, and its current financial health?

Don’t be blind and invest in any organization that does your research properly. A good asset can help you make a significant amount of money, but a bad decision can also put your finances at great risk, so be careful.

5. Consider Fixed Interest and Cash

Fixed Interest is the safest option as you will get returns no matter what. For example, fixed deposits and bonds offer interest depending on how much you are putting aside. There is very minimal risk, but even if the market is volatile, you will get returns on time.

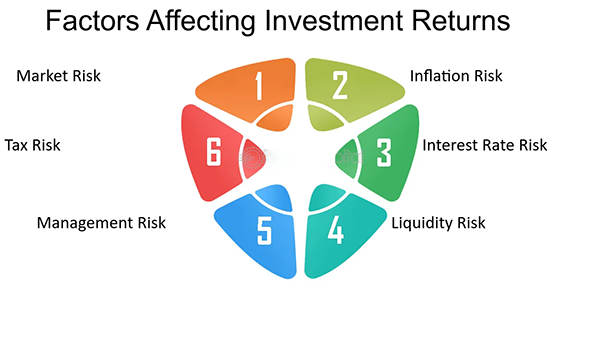

On the other hand, cash helps you jump on any opportunity that pops up in the market because of its liquidity. Cash also comes with very little to no risk and is a great way to generate income. Different factors affect your investment returns, and you can learn about those with the help of the infographic below.

6. Keep Up with Legislative Changes

You have to be up-to-date with legislative changes as they directly affect your portfolio. For all the tax regulations, retirement account rules, and domestic investing laws you have to have knowledge of all this and keep tabs on what changes are being made and then make changes in your investments according to it.

You’ll be able to avoid penalties and can take great tax benefits. And in this case, you can take the help of a financial advisor or consultant. So here you have it, everything that you need to know before making an investment and self-managing. If you can follow these points, you’ll be able to avoid a lot of trouble.