As a seasoned taxpayer professional myself, I’ve witnessed the rapid evolution of tax practices firsthand. From the laborious manual processes to the fine advent of digital tools that have revolutionized the way we file and manage taxes.

However, the latest integration of Artificial Intelligence (AI) and Machine Learning (ML) into the realm of IRS audits and tax compliance has taken this transformation by storm.

In fact, the impact is so significant that as of 2019, 38% of the countries were using AI and ML in the Tax Administration process (Source: OECD report “Tax Administration 2023”)

So, in this read, I will navigate you on how AI and ML are enabling the IRS to manage their business with greater precision. Along with how to find out if you have any tax debt or not.

Let’s start!

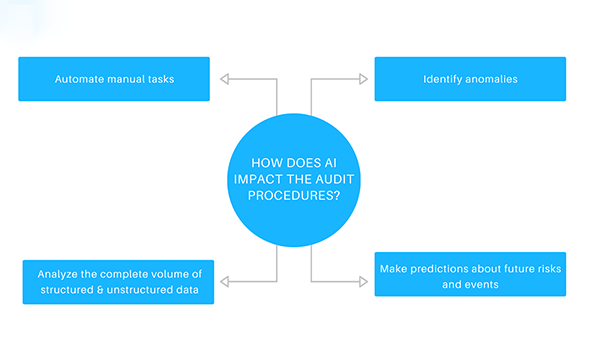

Artificial Intelligence (AI) and Machine Learning (ML) are making waves in a range of industries, and the field of taxation is no exception. The IRS has been embracing these technologies to improve the efficiency and overall accuracy of its audit processes.

Traditionally, the auditors used to spend countless hours manually reviewing tax returns, financial statements, and other documents. However, with the arrival of AI and ML in the segment, these repetitive tasks can be automated, leaving auditors to focus on more complex and strategic issues.

For instance, AI-powered software can quickly scan a document for its inconsistencies, errors, and red flags, significantly reducing the time it takes to complete an audit.

These AI and ML algorithms are also trained to analyze large datasets to identify the trends and patterns that may indicate any signs of tax evasion or non-compliance. This is a great strategy that enables the IRS to prioritize audits and allocate resources more effectively.

Additionally, AI and ML technology can also help you improve the accuracy of the risk assessments, by analyzing various factors like income level, deduction, and tax history. So, by leveraging the full potential of AI and ML, the IRS can identify the vast amount of data, and detect anomalies that are indicating any potential tax fraud and non-compliance.

Not only is it revolutionizing the audit process, but AI and ML also play a huge role in promoting tax compliance and detecting fraud. So, here’s a specification that can help you understand how AI is being used to enhance tax compliance and fraud detection.

Do You Know?

Some experts in the segment predict that AI and ML will automate many routine tax tasks, freeing up human auditors to focus on more complex cases

While AI and ML offer a range of striking benefits in tax administrations, it’s still crucial to address the potential biases of AI algorithms. That might sometimes lead to the unfair treatment of some taxpayers. So, to mitigate this risk properly, it’s essential to:

By striking a proper balance between efficiency and fairness, The IRS can leverage the power of AI and ML to improve the tax administration without even compromising the taxpayer’s rights.

The increasing use of these fine technologies in IRS audits has some significant implications for taxpayers, too. And, while it can improve the overall efficiency and accuracy of the audits, they can also sometimes raise concerns about privacy. So, to maintain the risk associated with AI-driven audits, Taxpayers should:

In brief, the striking involvement of AI and ML in the realm of IRS audits and tax compliance marks a major milestone in the evolution of tax administration. This transforms the way the IRS operates, enabling it to identify tax frauds more efficiently, while also streamlining the audit process and taxpayer services.

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.