As a small business owner myself, I’ve learned the hard way that navigating the complex world of credit cards can be a daunting task. (Speaking of my own experience)

And, it’s also so easy to get caught up in the enticement of low rates and flashy marketing, making it crucial to pay close attention to the fine print in your credit card service agreement.

And, since payment methods have been evolving rapidly, where 81% of consumers prefer to pay with cards over cash, and 82% of adults in the US have a credit card account in their name.

So, in this read, I’ll be sharing my personal insights to help you understand what you need to look for in your credit card processing service agreement.

Let’s start!

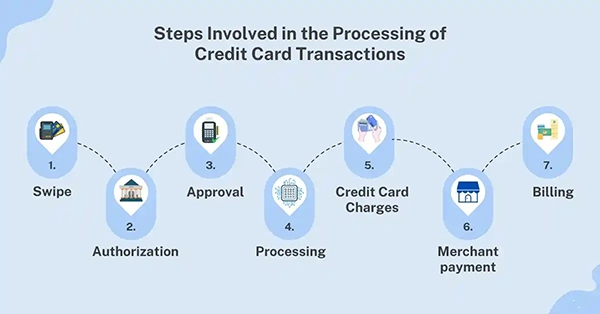

A credit card processing service agreement is a contract that outlines the legal stuff between a business and a payment processing provider. This agreement includes the terms and conditions provided by the payment processor. The agreement includes the complete breakdown of the fees charged, the responsibility of each party, and what the dispute resolution process looks like.

When I first started my business, I was so into running it properly that I didn’t pay much attention to the details of my credit card processing agreement. But thankfully, I realized sooner that a poorly negotiated agreement can lead to a variety of problems. Here take a look at some of them:

Did You Know?

Many credit card processors offer additional services like fraud prevention and chargeback management. This can help protect your business from financial losses.

As I dive deeper into the world of credit card processing, I learn that certain provisions in your agreement can significantly impact your business. So, here I have scrutinized the five key areas that you need to look for in your credit card processing agreement.

One of the first things I want you to look for is the early termination fees. It’s a fee that’s usually charged when you decide to cancel your agreement before the agreed-upon terms.

Some agreements consist of hefty termination fees, which can be a major financial burden. And, this is why I would highly recommend you negotiate for a lower fee or even for a fee-free termination period.

Another crucial aspect that you need to look for is an automatic renewal. This is a clause that allows you to automatically renew your contract for a specific period, often without your explicit consent. So, to avoid getting locked up in the long-term, I would suggest you opt for a month-to-month agreement or a shorter renewal term.

The agreement should have a clear mention of the processor’s right to withhold and withdraw funds from your accounts. This typically happens in the cases of chargebacks, disputes, or non-compliance with the terms of the agreement.

If you’re leasing credit card processing equipment such as terminals or card readers, your agreement should specify the terms of the lease. Including monthly rental fees, maintenance charges, and ownership transfer options.

Your agreements may have a transactional limit, such as a maximum transaction amount or a daily processing limit. These limits can have a significant impact on your business operations, especially if you experience periods of high sales volume.

So, by carefully reviewing these five key areas, you can ensure to have a smooth credit card processing experience.

In closing, navigating the complexities of credit card processing agreements can be a little overwhelming, especially for small business owners, but it’s also essential for the overall financial health of your business. And, by understanding the key provisions that I mentioned here in this read and negotiating for your favorable terms, you can minimize the cost, optimize operations, and protect the bottom line.

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.