No doubt that in the last few months, the cryptocurrency market has experienced a meteoric rise.

From a niche concept to a global phenomenon, digital currencies have captured the attention of millions.

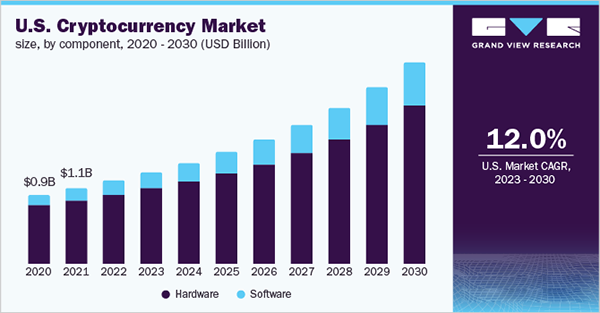

As the report stated, the worldwide cryptocurrency market was valued at USD 910.3 million in the year 2021 and is forecasted to be worth USD 1,902.5 million by the end of the year 2028 (Fortune Business Sights, 2024).

This rapid growth is driven by factors such as technological advancements, increased institutional adoption, and growing investor interest.

However, the market is still very risky; prices can change anytime, and even the government is still figuring out the best way to run it.

Therefore, in this ever-changing milieu, it would be great to take a closer look at this blog to analyze the current state of the market, so you can avoid the potential rising threats.

Historical Context and Market Maturation

The crypto market’s existence has been marked by dramatic cycles of boom and bust.

The initial 2021 peak, which saw Bitcoin reach nearly $69,000, generated predictions of Bitcoin hitting $100,000 or even $1 million.

Whilst these projections, at least the ones at the higher end are not quite based on concrete, fundamental analysis, Bitcoin is still doing extremely well as of now, crossing the 80 thousand USD mark.

Early 2024 has shown signs of market stabilization, with the big coins maintaining relatively steady trading ranges compared to their historically volatile patterns.

One of the most significant developments in the crypto space has been the increasing institutional adoption.

Major financial institutions that once dismissed cryptocurrencies have established dedicated crypto trading desks and services.

The approval of Bitcoin ETFs by the SEC marked a watershed moment, signaling growing acceptance within traditional financial frameworks.

However, public perception remains mixed; a Pew Research survey indicated that when awareness of cryptocurrencies increased, trust in them as a viable investment vehicle has declined since the infamous 2022 market crash.

The collapse of major platforms like FTX has contributed to ongoing skepticism about the industry’s stability and legitimacy, proving once again just how much damage even a single horrible instance can do.

Of course, outside of this, there are plenty of big and small scandals that often get put in the public eye, certainly not helping the market at all.

Though Cryptocurrency has fallen into many controversies, the market still found a strong footing in several specific sectors, such as online gambling and gaming.

The gambling industry has emerged as one of crypto’s strongest allies, with digital currencies offering solutions to traditional payment processing challenges and regulatory complications.

Whilst this does have the potential to contribute to the above-mentioned public perception in a negative light, from a pragmatic point of view, many unbelievable statistics prove just how lucrative casino collaborations are for the crypto market.

Still, for them to maintain this collaboration, they need to add value back, and so far they have been accomplishing that decently well.

Casinos mainly benefit from fresh game variations, like Bitcoin roulette at Bovada, and all the basic perks that come with crypto transaction methods, say lower fees, faster processing, security, etc.

Just looking at allies is not quite enough to get the full picture of the industry’s current position, and trading volumes provide a more nuanced picture than price movements alone.

Overall crypto trading volumes in 2024 remain comparable to the initial 2021 peak and have stabilized at levels significantly higher than pre-2020 figures.

This suggests a more mature market with sustained institutional interest rather than a declining one.

Also, bear in mind that the laws and rules are equally pivotal in cryptocurrency, as they contribute to market stability.

However, it has also led to consolidation among crypto businesses and higher barriers to entry for new projects.

Therefore, the big crypto industry has been shifting toward more regulated and transparent operations, with major exchanges implementing stricter compliance measures.

This professionalization of the crypto sector has boosted the public perception, therefore trust, and the willingness to give the industry a chance.

Do You Know?Around 562 million people worldwide, or the equivalent of 6.8% of the global population, now own digital currencies.

Cryptocurrency, the market that once seemed to be risky, is transforming and is shifting its focus from pure speculation to developing practical applications and infrastructure.

In order to make more improvements in the crypto field, various technologies have been implemented.

Such as Layer 2 solutions that improved scalability and continue to address earlier limitations of blockchain technology.

Some may call this process maturing, however, it would be better for the industry if the days of selling delusions are behind us, and the coins take their niche place alongside the traditional transaction methods, as opposed to their replacements.

The market has found strong niches in gaming, gambling, and financial services, suggesting a transition from pure speculation to utility-driven adoption.

This evolution, while perhaps less exciting than the bull runs of previous years, potentially positions the crypto market for more sustainable long-term growth.

The challenge ahead lies in balancing innovation with regulation, environmental responsibility, and practical utility – factors that will likely determine the market’s future trajectory more than price speculation alone.

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.