The landscape of the payment method is changing rapidly and there is an influx in the introduction of cutting-edge technologies that seek to enhance the payment process.

One such area that seems to be the most active is the creation of biometric payment systems in which the payment is processed using phonetics or biometrics, such as using a thumbprint, face, or even the pupil to authorize the payment.

A more recent entrant in this area is the JP Morgan Chase who has been one of the leading financial services companies entering this area in a bid to transform payment processing and merchant services. Also, learn about Right Ice Cream Cart Supplier by reading this article.

This blog examines the biometric payment model that JP Morgan is currently developing within its scope and also analyzes the expected changes and patterns that it will bring to the payment systems.

JP Morgan’s biometric payment system applies the most sophisticated biometric devices to scan the defining characteristics of a user which are later used to authenticate the transactions.

The method goes through the steps given below so as to complete the payment procedure:

When the data analyzed conforms with the data obtained in storage, the transaction is executed.

This way the system boosts security and also makes it easier to pay for goods, hence lowering the chances of using cards or cash.

The Biometric Payment Method introduced by JP Morgan comes with several advantages, simplifying the way you do online transactions:

It is inherently quite harder to steal biometric identities than PINs and passwords.

Do You Know?

After the internet became available in 1991, the first online payment was made by a consumer in 1994.

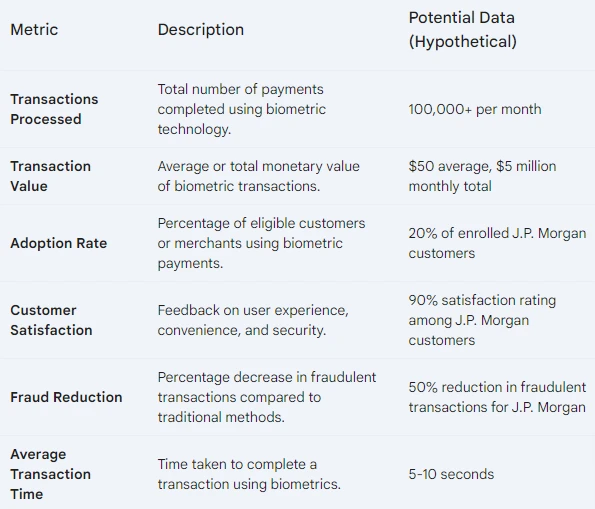

The fact that JP Morgan is venturing into biometric payments will most likely significantly alter the payment landscape with respect to payment processing, credit card processing, and provision of merchant services.

With the rise of biometric payments, there may be fewer people using credit cards and cash or other forms of payment not requiring physical biometric tokens.

This would change the landscape of payment processing, as more and more firms would turn to incorporating biometrics in payment technology.

The entry of biometric payments such as the ones introduced by JP Morgan will be viewed as a competitor by the other numerous banks and payment processors in operations.

The companies will have to come up with new products and technologies in the fast-changing markets.

Merchant services such as payment processing, fraud detection and resolution, and customer support are expected to evolve with the trend of more users preferring payments through biometrics.

There may be a need to upgrade payment and POS systems, install biometric receptors, and provide more protection.

The use of biometrics entails the collection and use of customers’ personal information which raises the issue of regulatory and privacy liabilities.

For biometric payments that are becoming popular among consumers, rules need to be created in order not to lose the advantages of these payments.

The successful implementation of JP Morgan’s biometric payment can lead other organizations and financial industries to adopt similar payment methods.

However, to ensure the widespread acceptance of this method globally, there’s a need for setting up universal rules regarding the storage, verification, and security of biological data to ensure security and compatibility across different markets and regions.

The increasing popularity of the Biometric Payment method might eliminate the use of physical credit cards.

Looking at the trends, more and more people are going to embrace biometric methods, and this may reduce the need for physical cards causing a decline in the issuance and use of credit cards.

This may in turn affect the earnings of card companies and payment processing organizations.

In order for biometric payments to succeed, consumers must be assured that their biometrics are safe and the payment system is effective.

This trust development will be critical for the large-scale uptake which is presumably expected.

For this, JP Morgan and other companies in the space will need to educate the advantages and safety of this method to the consumers to help them adapt this innovation more securely and efficiently.

Surely, the Biometric Payment method introduced by JP Morgan has ample advantages, however, there are also some challenges and considerations that as a customer you should be clear about.

These include:

It is right to conclude without any doubt that JP Morgan’s biometric payment system will influence the industry in one way or the other.

As this technology continues to advance and bring benefits to cardholders and business owners in the short term, that day is not too far when biometric authentication will become the standard for all types of transactions, from in-store purchases to online payments.

However, there are still many potential challenges and issues, mainly security and privacy concerns that need to be addressed to achieve this goal.

JP Morgan’s biometric payment approach is radical and touches on the heart of the transformation of the payment system in the coming days.

As technology evolves, it will have a substantial impact on payment methods, credit card transactions, and merchant services.

Furthermore, this innovation will signal a significant shift in our ideas and thoughts about transactions; provided that the inherent concerns are addressed, JP Morgan’s biometric payment will become the widely acceptable transaction method worldwide.

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.