As you step into the world of commodity futures trading, it becomes absolutely pivotal to understand rollover so that you can hold your positions without interruptions.

It essentially allows the trader to extend an existing contract by closing an expiring position and opening a new one.

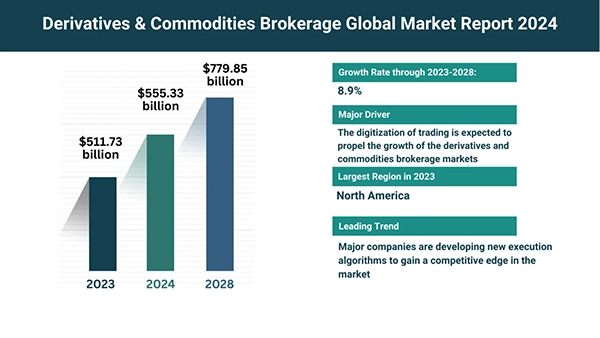

Also, with commodities market value expected to reach US$121,200.00bn by the end of the year 2024 (Source: Statista 2024), it’s become more advisable for traders not to take chances and rollover contracts on a need basis.

To assist you more in this, this article will explain what exactly rollover is and why it is of immense value for successful commodity trading over a long period.

Rollover in commodity futures trading is a technique by which traders can shift their positions from a near-expiring contract to a contract of later maturity to continue trading in the same commodity.

For instance, you bought a gold futures contract that is about to expire in three months but you want to keep it.

For this, you will sell it and purchase a new one that will take three months to expire and align with specific futures rollover dates.

These dates are relevant more so because they result in high trading turnovers and other activities affecting the liquidity and price of securities.

Thus, if the rollover is conducted around these dates it will help reduce the expenses and threats linked to the trader’s position in order to maintain the continuation of trading operations.

Do You Know?

The Commodity Futures Trading Commission (CFTC), an independent agency of the US government was created in 1974 to regulate the U.S. derivatives markets.

The main purpose of rollover is to keep a trader’s position open on a particular market without having the underlying commodity.

Since a large number of people who trade in commodity futures do not require the actual delivery of the goods they are trading, rollover enables them to carry on with the process smoothly without any hitches.

However, rollover affords choice and enables the trader to take his positions to where they may be most wanted depending on the markets and their expected move.

For example, if a trader expects the price to decline after the contract expires their contract can be rolled over with a better price.

On the other hand, in the event that there is a prospect of a rise in prices, it may be profitable to roll over early.

There are two common rollover strategies operated by commodity futures traders that are – ‘long‘ and ‘short‘ rollover.

These strategies consist of exiting a position in the last active contract and at the same time entering a position in the next active contract.

Traders who use this strategy think that the market will keep moving upward and keeping long exposure is profitable.

Buyers relying on this strategy expect a downtrend and want to keep their short positions.

These strategies are not confined to the taking over of positions from one contract to another of the same commodity.

There is also the ability to trade across different contracts in related commodities or options contracts for higher-level risk management.

There are several factors that traders consider when deciding to roll over their positions:

This can be done in order not to experience losses caused by fluctuations in the price of the underlying assets by traders.

If the roll yield is positive, the traders should roll over their positions.

Such costs can be taken from the profit or else, can contribute to the losses if those are not managed well.

To summarize, rollover is a key feature of commodity futures trading that enables traders to keep their positions open through natural attrition.

Given the growth in continuous expansion in the commodities market, the use of rollovers effectively provides traders with a major competitive aspect for longer periods.

It enables traders to maintain focus on the market without practical engagement with the physical commodities even after their contracts lapse.

This is particularly helpful regardless of an individual’s experience because rollover will allow the market novice or the advanced user to be in touch with market developments enabling better trading decisions.

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.