For an accountant, having knowledge of handling accounts with the help of tech is more necessary than ever. Researchers say that e-learning lets accountants access limitless information sources and versatile interaction (Aysel Güney, Role of technology in accounting and e-accounting).

This knowledge of tech in accounting allows accountants to master their skills with the latest tech infra available, for the most efficiency possible. Accounting tech may also resonate with fintech in some cases, which includes modern tech elements like cloud computing, robotic process automation, AI-ML, Internet of Things, and many more.

So, stick to this writing till the end to get a better picture of how tech in helping accountants around the globe for better business performance.

Advanced-Data Analytics

The whole purpose of data analytics is to turn tons of available data into readable information. According to SeedScientific, there are more than 2.5 quintillion bytes of data available.

But what’s the point of this data when no one can understand it?

This is where data analytics from an accounting point of view comes into the limelight. The Adelaide accounting firm and many similar firms value such professionals who can use the available data in something useful that might help businesses foster.

The accountants dealing with this area are responsible for managing, analyzing, and mining the multiple data streams. But how does this make a change? Here’s how:

- Evaluate Performance: Companies evaluate their market performance on the basis of some key metrics like revenue data, quarterly goal performance, etc.

- Mitigate Risk: Risks related to funds, investments, etc. can be forecasted and mitigated with correct timings and a planned approach.

- Understanding Market Behaviors: How the customers are shifting their interests in different areas of the market and where they are investing more, helps understand their behavior and expectations.

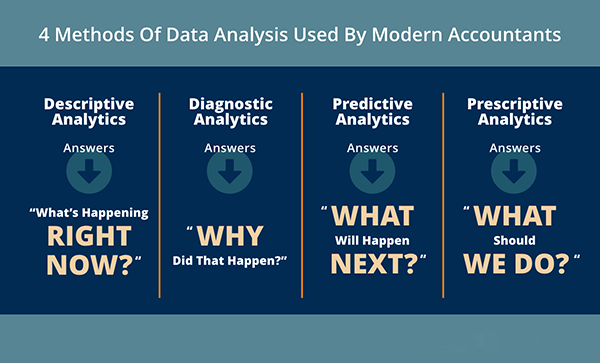

These are the four stages in which data analysis happens.

Real-Time Financial Insights

Anything related to finances needs to be watched in real time. Unlike traditional financial analysis, where historic data and records are considered, real-time insights are analyzed at the moment. Despite the fact that it comes with its own challenges, the approach provides various benefits that might be helpful for businesses.

The following are some of those challenges:

- Implementation Cost: Real-time analysis and insights are too tricky to perform and require a lot of expertise. Hence, it comes with hefty charges and expenses.

- Not for Small-Scale Businesses: It might be difficult for small-scale businesses to implement this. If you still want to do so, try to give it a slow start.

- Finding Qualified Partners: Finding the right service providers and resources for the cause might be difficult.

Automation for Efficiency

In simple words, there is some accounting automation software that helps you automate recurring operations with ease. Compared to the situation where accounting professionals need to do all tasks manually, automation significantly helps in making operations quick and efficient.

Here’s how automation in accounting is much better than the traditional method:

- Traditional accounting is much more time-consuming than automated accounting.

- Automated accounting is less or almost zero percent prone to making illogical human errors, while there are always some chances to make mistakes in manual accounting processes.

- Modern automated accounting is a more secure way to handle accounts than the traditional way.

Cloud-Based Accounting Solutions

When holding accounting records becomes difficult for huge-scale businesses, cloud-based solutions come into the limelight. The cloud lets businesses host their accounting servers in a remote location, where businesses do not need to have an on-premise server for storage.

Since now the data is stored at a remote location, it does not matter if the on-premise server gets into trouble or anything, their information will be kept safe on cloud servers. This way not only do they provide convenience and accessibility, but also better security.

Some key features of cloud accounting include:

- Reporting and Visibility

- Accessibility

- Real-time data

- Automation

- Integration

- Scalability

- Security

- Collaboration

Since now you can enjoy all these features, there would hardly be any reason to refuse a cloud system (except for your budget).

Enhanced Cybersecurity Measures

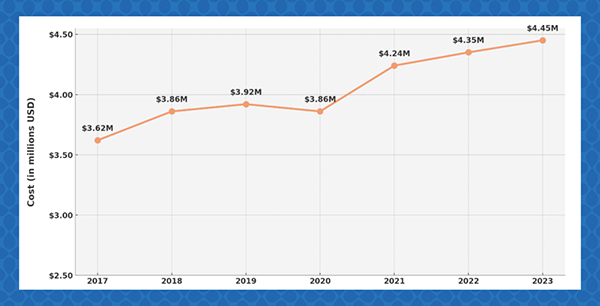

Cybersecurity is a necessity in almost every field nowadays. As you can see in the graph below, the cost of accounting cybersecurity is continuously on the rise. This means it is high in demand.

The General Data Protection Regulation is the European Union’s new protection law, that intersects with cybersecurity and accounting in the following ways:

- Data protection by design

- Data minimization and storage limitation

- Breach notification requirements

- Access controls and authentication

- Data processing agreements

- Client transparency and rights

With these areas, data security in accounting is ensured.

Future Outlook – Integration of Artificial Intelligence (AI)

Lastly, technology is going to make its way into almost every aspect of your lifestyle, and accounting is no exception. With the current trend, there is nothing that is going to stop the integration of these two aspects, and it is only going to rise in the near future.

With the future predictions and current signs, it can be easily predicted that AI is going to make a huge change in the domain with absolutely no problem at all. If you find this article helpful in any way possible, consider sharing it with your team as well.