Did you know? In 2009 the first-ever cryptocurrency that was curated on the blockchain systems was none other than Bitcoin.

Over the 15 years of its existence, we can see the rise and fall of this asset numerous times. The origin of this everlasting asset is still a core mystery for the people who are investing in it today.

According to some sources :

Bitcoin was the brainchild of Satoshi Nakamoto, a pseudonym used by the author of a white paper written in 2008. Several people have claimed to be Nakamoto, but his true identity remains a question. (Hartford funds).

Except for these unknown answers and unclaimed facts, we also have some evolution demographics of this currency and this article aims to provide all of them.

So, let’s unfold this chapter!

Bitcoin’s early years were an endeavor in anonymity, a weird and somewhat hidden period where it was both revered and doubted, celebrated and brushed away. Few saw what it was, fewer still saw what it would become, and most of the financial world thought it was a flash in the pan. It was in those early days a digital curiosity – puzzling to some, laughable to others, and loved most by those on the fringes of the banking industry.

It was used at times in unsavory ways – black market sites started accepting Bitcoin as a currency, and it gained a reputation that was both dodgy and cool. This early period taught us that Bitcoin would not follow traditional paths. There would be no smooth road to acceptance; it would find a niche, and thrive in its ecosystem, and mainstreams were unaware of it.

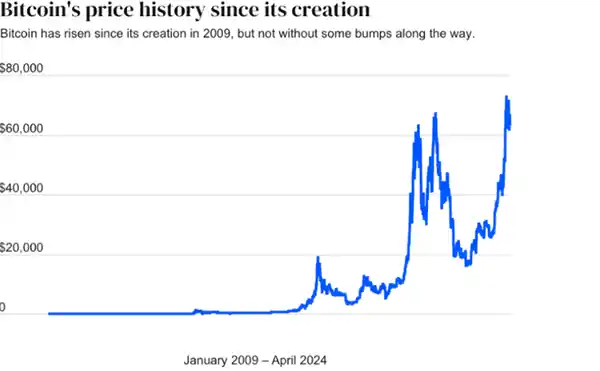

As you can acknowledge, this graph witnesses the robust growth of this fungible token over the years in the crypto market.

After the slow and remarkable growth of this currency, it was time for its first boom. In 2013, Bitcoin broke out of the tech circles and into mainstream conversation as the price started to skyrocket, defying all economic laws.

Speculators arrived in large numbers, the air was filled with chatter, and there was a sense of gold rush fever in the air. And then—well, the price came back to square one. No gradual decline, no gentle ebb and flow, but a crash so sudden the word “bubble” was unimaginable, and the financial media pounced with glee.

This was not a one-off. Bitcoin has gone through these boom-bust cycles like a wayward comet, flaring up and then disappearing from view, and then, inexplicably, rising again. As history shows, Bitcoin’s unpredictable behavior is both its blessing and its curse. If we look to the future through this frame of reference, it may be that these cycles of hyper-growth and new observance of innovations.

If Bitcoin’s booms and busts are its most dramatic chapters, the quiet march toward legitimacy has been its most surprising. The institutions that never believed in the very idea of Bitcoin are now actively participating in creating exchanges, facilitating transactions, and even adding Bitcoin to their portfolios as a kind of “digital gold”.

But this has not been without contentious issues. The idea of Bitcoin’s original decentralized ethos sits uneasily alongside Wall Street endorsements and regulation, and some argue that this acceptance was influential for financial freedom.

But mainstream adoption was always going to happen. Bitcoin has shown a resilience few assets can match, surviving crises, regulation, and the scorn of the old guard. It has become a contractual outlier, an asset that operates by its own rules. As for what this means for the future, one would expect Bitcoin to endure to walk the tightrope between two worlds: its rebellious spirit and institutional credibility.

Fascinating Tidbits

The maximum number of Bitcoins that will be created through mining is 21 million. As of December 2023, there were about 1.4 million Bitcoins left to be mined.

(Hartford funds).

While Bitcoin’s crowdfunding journey has been the focus of the public’s attention, its technological evolution had some of its critical changes. Originally designed as a peer-to-peer payment system, Bitcoin’s use as a currency has been quite limited compared to its use as a store of value.

The network is not designed for high-transaction expenditures, so some limits will impact its future. Recent developments—layered solutions like the Lightning Network—suggest attempts to expand the use cases and make Bitcoin a more practical currency, but the outcome is unknown.

And so, if history is any guide, Bitcoin will be both a mystery and a force, captivating the minds of enthusiastic researchers and the wallets of investors even as it ignores the rules of finance.

Maybe what the history of Bitcoin shows most clearly is its growth demographics, and the ability to survive crises that would kill other assets. It’s like a mythological creature—a phoenix or a hydra—that no amount of chaos can fully destroy the world.

Its future, like its past, potentially in its ability to be the best of the rest. It’s both a middle finger to centralized power and an asset class; a refuge for the disillusioned and a tool for the rich; a crazy investment and, paradoxically, a “haven” in times of economic chaos.

Every time Bitcoin goes up, it seems to hint at possibilities not yet fully realized, a future where money is less about control and more about choice.

In the end, we’ll just have to wait and see how Bitcoin continues to be both loved and hated, bought and sold, held tight by some, and avoided by others. And so, as with any good tale, we’re left wondering not what it means but what’s next—amazed, confused, and maybe even delighted by this weirdo in the 21st-century financial soap opera.

Thanks for choosing to leave a comment. Please keep in mind that all comments are moderated according to our comment Policy.